Join a Credit Union in Wyoming: Personalized Financial Providers for You

Wiki Article

Elevate Your Banking Experience With Cooperative Credit Union

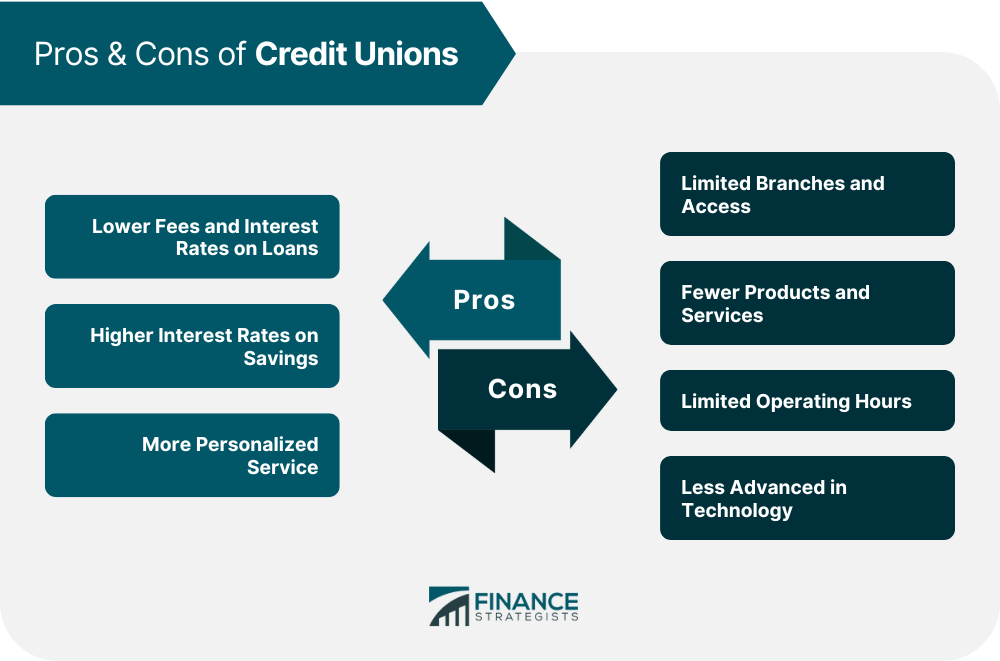

Debt unions, with their focus on member-centric solutions and neighborhood participation, provide an engaging option to traditional financial. By prioritizing private needs and promoting a feeling of belonging within their membership base, credit scores unions have actually carved out a niche that reverberates with those seeking an extra customized strategy to managing their funds.Benefits of Lending Institution

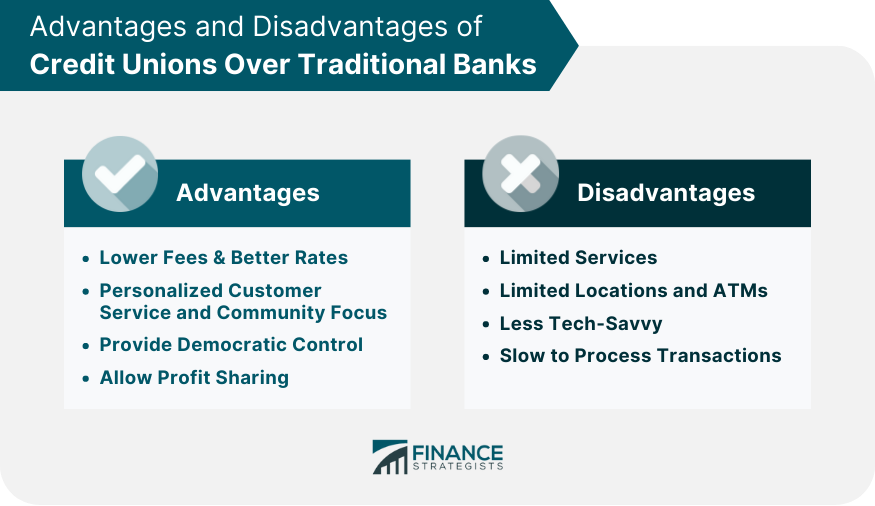

Unlike banks, credit rating unions are not-for-profit organizations had by their members, which typically leads to lower fees and much better rate of interest rates on financial savings accounts, financings, and credit rating cards. Additionally, debt unions are known for their personalized client solution, with staff members taking the time to recognize the one-of-a-kind economic objectives and obstacles of each member.

An additional benefit of lending institution is their autonomous framework, where each participant has an equivalent ballot in choosing the board of directors. This guarantees that choices are made with the finest passions of the members in mind, instead than focusing only on taking full advantage of revenues. Credit score unions commonly offer financial education and learning and counseling to help participants enhance their economic proficiency and make educated decisions regarding their money. Overall, the member-focused method of lending institution sets them apart as institutions that focus on the wellness of their community.

Subscription Requirements

Lending institution usually have specific standards that people need to fulfill in order to enter and accessibility their monetary services. Membership demands for cooperative credit union typically involve eligibility based upon variables such as an individual's area, company, organizational affiliations, or other qualifying relationships. For instance, some cooperative credit union might serve people who function or live in a certain geographic location, while others may be associated with specific companies, unions, or associations. Additionally, relative of existing cooperative credit union participants are often eligible to join too.To become a member of a lending institution, people are typically called for to open up an account and keep a minimal down payment as defined by the organization. In many cases, there may be one-time subscription fees or ongoing membership dues. When the subscription criteria are fulfilled, individuals can enjoy the benefits of belonging to a credit report union, consisting of access to customized financial services, competitive passion prices, and a concentrate on participant complete satisfaction.

Personalized Financial Services

Customized economic services customized to individual needs and preferences are a characteristic of cooperative credit union' dedication to participant complete satisfaction. Unlike traditional financial institutions that frequently provide one-size-fits-all solutions, debt unions take a more individualized technique to handling their members' financial resources. By understanding the distinct goals and situations of each participant, debt unions can give customized referrals on financial savings, financial investments, loans, and other financial products.Credit unions focus on constructing strong partnerships with their members, which enables them to use personalized solutions that go past just the numbers. Whether somebody is saving for a certain objective, preparing for retired life, or looking to enhance their credit report rating, credit score unions can develop customized financial plans to assist participants attain their goals.

Federal Credit Union Additionally, credit score unions commonly use lower costs and competitive rates of interest on savings and lendings accounts, better enhancing the individualized financial services they offer. Credit Unions Cheyenne. By concentrating on private demands and providing customized options, credit score unions establish themselves apart as relied on monetary partners committed to assisting participants thrive economically

Neighborhood Participation and Assistance

Neighborhood interaction is a cornerstone of cooperative credit union' mission, showing their dedication to sustaining neighborhood campaigns and cultivating purposeful links. Cooperative credit union actively get involved in community events, enroller regional charities, and arrange economic proficiency programs to enlighten non-members and members alike. By buying the areas they offer, lending institution not just strengthen their relationships yet additionally add to the total well-being of culture.Sustaining small businesses is one more method credit unions show their dedication to regional areas. With offering bank loan and financial suggestions, credit score unions aid business owners flourish and promote economic development in the area. This support surpasses just financial assistance; lending institution typically give mentorship and networking possibilities to aid small companies do well.

Additionally, cooperative credit union regularly take part in volunteer work, encouraging their members and workers to repay via different community service activities. Whether it's joining local clean-up occasions or arranging food drives, credit scores unions play an energetic duty in boosting the top quality of life for those in demand. By prioritizing area participation and assistance, lending institution truly symbolize the spirit of collaboration and common support.

Online Financial and Mobile Apps

Mobile apps supplied by credit rating unions further improve the financial experience by providing additional flexibility and access. Generally, credit rating unions' on the internet financial and mobile applications equip members to handle their financial resources successfully and firmly in today's busy digital globe.

Final Thought

Finally, cooperative credit union offer an one-of-a-kind financial experience that prioritizes community participation, customized solution, and member contentment. With lower fees, competitive rates of interest, and customized financial services, lending institution deal with individual demands and advertise monetary health. Their democratic structure worths member input and supports regional communities through numerous campaigns. By joining a lending institution, people can raise their financial experience and construct strong relationships while taking pleasure in the advantages of a not-for-profit banks.Unlike financial institutions, credit score unions are not-for-profit companies owned by their participants, which typically leads to reduce costs and far better interest prices on cost savings accounts, fundings, and credit score cards. In addition, credit unions are understood for their customized client service, with team participants taking the time to recognize the distinct monetary objectives and challenges of each participant.

Report this wiki page